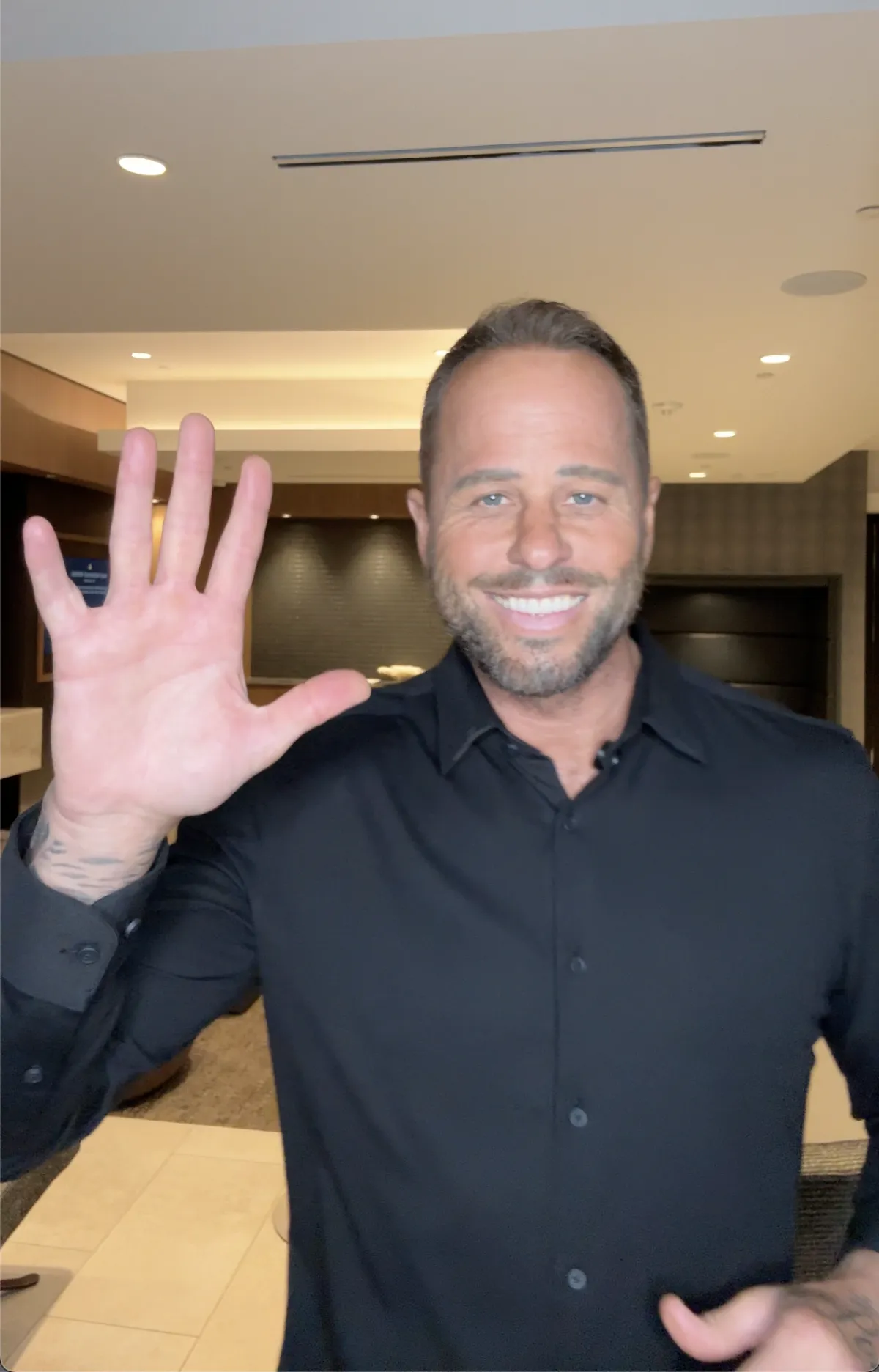

Brian MacDonald

Bio

Business Capital Advisor • Founder, Acquire Funding

I’m the founder of Acquire Funding, where I advise entrepreneurs on how to turn credit into business capital—and capital into long-term freedom.

Over the past decade, I've worked with thousands of corporations and entrepreneurs to unlock more than $1 Billion in funding for growth, acquisitions, and ownership.

My work is built on one truth most people never learn: the wealthy don't grind their way to the top. They use other people's money to acquire what's already working—proven businesses, real estate, and cash-flowing assets.

That realization reshaped everything I teach.

Core Philosophy

The wealthy understand something fundamental: real freedom comes from owning assets that produce income month after month, not from trading time for money.

They don't grind their way to the top. They use other people's money to acquire what's already working—proven businesses, income-producing real estate, and assets that generate cash flow.

Once you understand how capital, leverage, and structure work together, the entire game changes.

Background

I grew up in Northern California, where I learned early that hard work alone doesn't build wealth. Strategic ownership does.

My understanding of wealth deepened at American Express, where I spent years advising high-net-worth clients and C-level executives. Nearly every wealthy client I worked with shared the same pattern: multiple businesses, real estate portfolios, and income streams that didn't depend on their daily labor.

That's when it clicked. Lasting wealth isn't built by grinding through a job or betting everything on an unproven idea. It's built through ownership, supported by strategic use of capital.

In 2012, I launched my first e-commerce business, scaled it profitably, and exited within two years. That experience taught me that building from scratch isn't the only path—and often not the smartest one. Acquiring or scaling what already works is faster, safer, and more repeatable when you have access to the right capital.

Over the years that followed, I worked alongside dozens of business owners to improve operations, restructure growth strategies, and unlock the funding that allowed them to move from operator to owner.

Today, my work centers on one critical step: helping entrepreneurs build a fundable business profile and credit foundation that unlocks serious capital.

With the right structure in place, founders can skip the startup gamble and use funding to acquire proven, cash-flowing businesses or assets from day one.

This is where business capital stops being intimidating—and starts becoming a tool.

Mission

My mission is to help entrepreneurs take the one step that changes everything: building access to capital that creates real options.

With the right funding in place, you can acquire businesses or real estate that already generate income, skip the startup risk, and use leverage the way experienced owners have for decades.

Real financial freedom doesn't come from working harder. It comes from owning assets that pay you every month. The wealthy have understood this for generations, but it's rarely explained in a way that makes it accessible.

My work is about making that path clear, practical, and achievable for anyone ready to build something that lasts.

Current Ventures

Explore my current ventures below to see how these principles come to life. You’ll find resources throughout these sites that are designed to give you clarity before commitment: